We can never out-give God

GivingOfferingDonationTithing

Ways to Give

When it comes to our finances we can be extravagantly generous with our tithes and offerings. Let’s join together and give into what God is doing at Lighthouse Church.

If you would like to partner with us in reaching San Diego with the love of Christ & supporting the vision of Lighthouse Church please click here to give. Every gift makes a huge difference in a city like San Diego and we thank you in advance for your support and generosity.

See what God can do through your generosity.

01

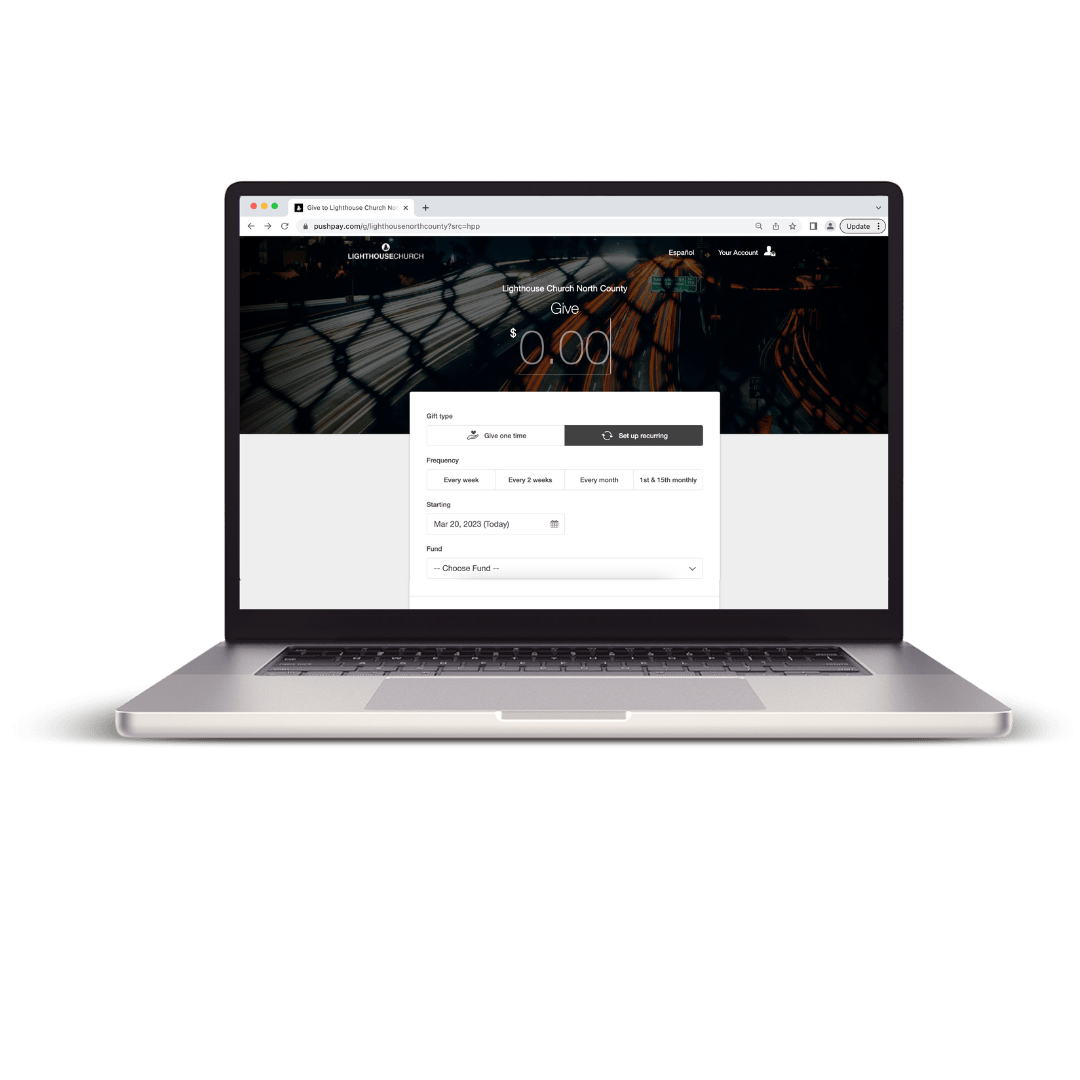

Online

Give Online

Simple and secure. Give a single gift, or schedule recurring giving using your checking account, debit, or credit card.

If you have any questions about your giving, online statements, etc… don’t hesitate to reach out and contact us at Info@lighthousechurchnc.com.

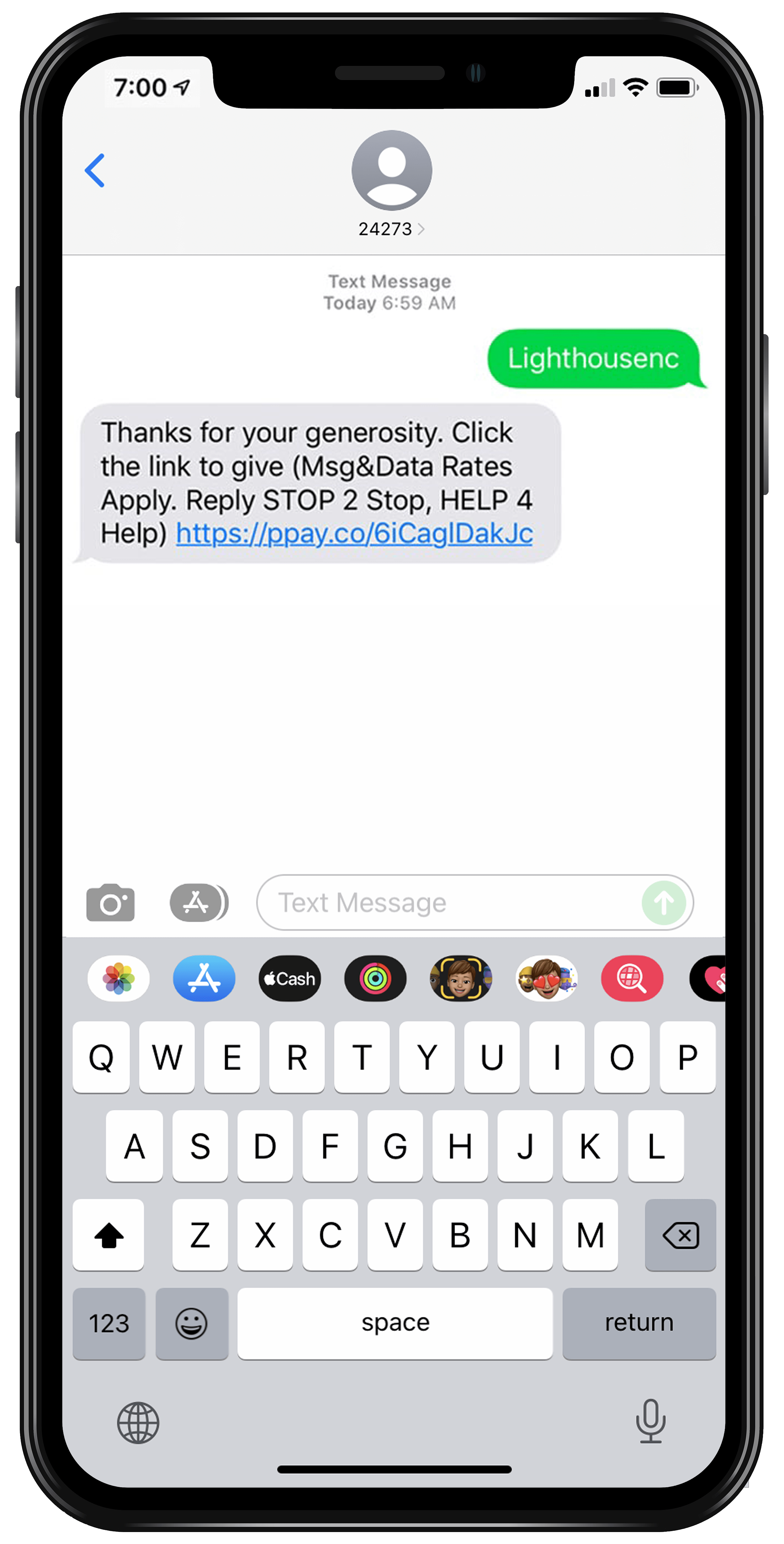

Text to Give

To give via text, text “lighthousenc” to 77977. Our Text Giving uses industry-leading security to protect your personal information and is never charged to your phone bill.

02

Text

03

In Person

Give In Person

Before or after a service, you can stop by the Welcome Tent to pick up a Giving Envelope. Insert your cash or check tithe/offering and drop it into the donation box.

Send a check

If you would like to give by cash or check, you can mail your offering to our Lighthouse Church North County offices. Please label the envelope with Giving, and put the fund you are giving towards (tithe, offering, outreach).

Mail To:

Lighthouse Church North County

342 Eucalyptus Ave., Vista, CA 92084